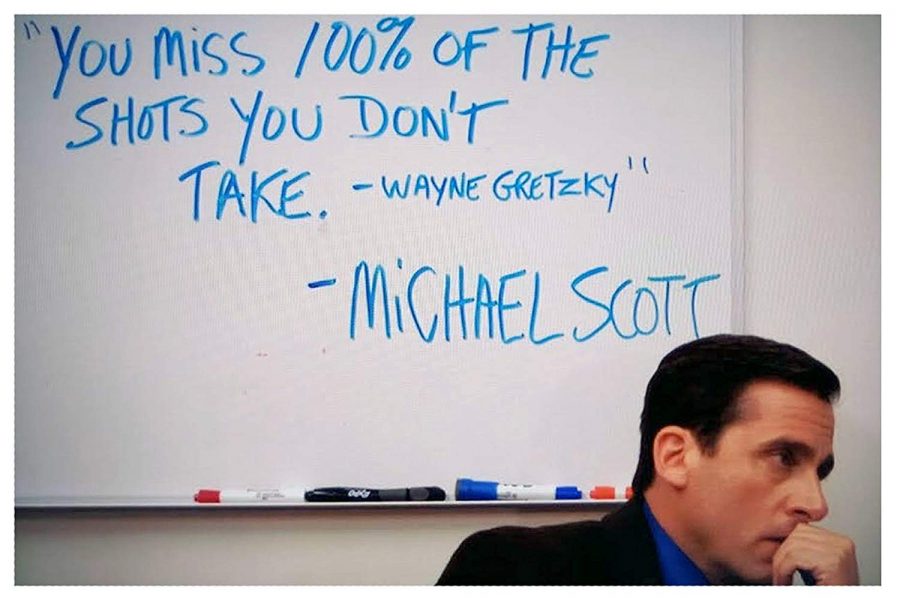

Wayne Gretzky was a smart dude, and not just about hockey. As cheesy as this saying can be, it holds true for investor reporting. Every interaction that you have with one of your investors is an opportunity to strengthen your relationship. Perhaps they will see something in your report that’s so intriguing, they can’t help but share it with their colleagues. By far, the easiest way to fundraise is to have your existing investors raving about you to their investor friends. That way, prospective investors come to YOU.

How can you accomplish this amazing feat? By making every interaction with your existing investors count. Let’s start with investor reporting on property performance. In this post, we’ll show you the top real estate KPI categories for reporting to impress your investors. Download our free whitepaper for the full list of the top 17 real estate KPIs for investor reporting.

Accountability is Key

I didn’t play hockey, but I did grow up with that Wayne Gretzky quote plastered all over our local basketball gym. During high school, I had a coach who was very data-driven. We set multiple goals per metric for each game. For example, we would set one goal for assists to be higher than last year and another to beat the current year target. After each game, we would either receive an award (i.e. no running drills) or punishment (i.e. push-ups for every metric of the goal missed). We once played a particularly terrible game, and our punishment added up to 568 sit-ups each. I couldn’t breathe without my abs hurting for days! But we had committed to our coach that we would try to achieve these metrics and be held accountable.* The same can be said for investor reporting.

*For the record, the terrible games were few and far between. Martin’s Mill girl’s basketball is now a phenom. Check them out!

The tricky part is: which metrics should you hold yourself accountable to? And over what time frame? Grab your sneakers and sweat towels, folks. We’re about to play some basketball! I mean… we’re about to go over the top real estate KPI categories for investor reporting.

Top Real Estate KPIs for Investor Reporting

And now, for tonight’s starters! For the first category, you will want to show a comparison from acquisition to the current period. You will also want to compare from underwriting to actuals current period. Then, you must demonstrate to your investors that you made marked improvements since acquisition. You also want to show that you matched or exceeded your underwriting.

Next, you need to give your investors an understanding of their properties’ risk exposure. Ensure you create real estate KPIs using a snapshot from the current period.

And now, the starting line-up for your Lady Mustangs! Um, I meant to say your current period analysis by category. Current period categories include overall performance, leasing, and financing. (I genuinely hope you read that last sentence in a deep announcer voice.)

Conclusion

Fans, that concludes today’s game. Congratulations to the owners, who now know the top real estate KPI categories for investor reporting to impress investors. If you haven’t already, download our free whitepaper for the full list of the top 17 real estate KPIs for investor reporting. We hope to see you all again next time!

Shameless plug *ALERT*: If you’re interested in learning how we can help you with KPIs for client reporting, reach out at CRExchange.io/contact.

Top 17 Real Estate KPIs for Investor Reporting