Real estate is an exciting business. It is also a numbers game. That’s why it’s critical to understand the key performance metrics (KPIs) that are important to a real estate business. Having daily access to your KPIs will help ensure that you maximize profits. Tracking and exceeding your KPI targets empower you to be proactive in keeping your occupancy high, vacancy low and income maximized while lowering your expenses. In this post, we will cover: the most important KPIs for real estate businesses, KPIs for different property types, and KPIs for real estate investors as the 12 Best Commercial Real Estate KPIs.

Want to learn more? Come explore our interactive demo reports and see how our analytics can help you grow!

*Note that our company has grown. We now have a software application called CREx Software that includes all of the reports in our interactive demo plus many more! Check it out.

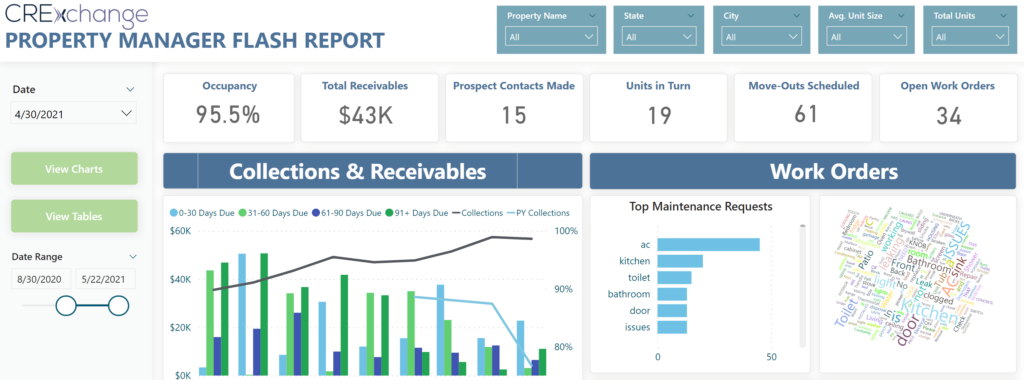

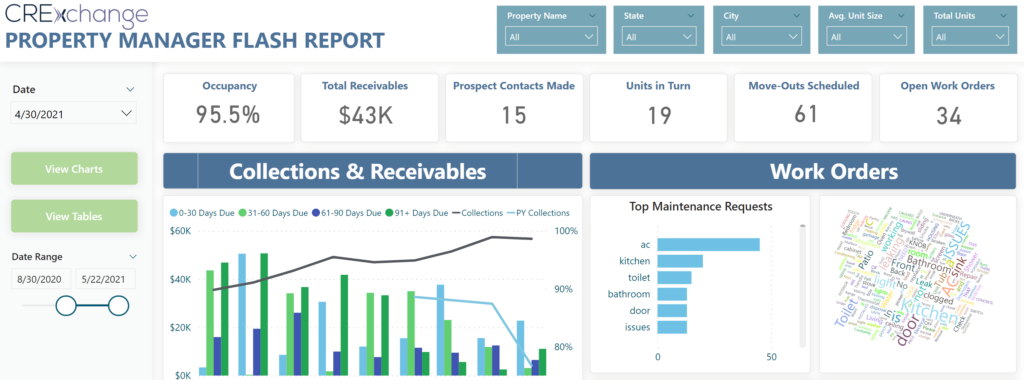

1. Aged Receivables

The aged receivables KPI will show how much outstanding cash is owned to you by the different tenants and vendors. Usually categorized in 30, 60 and 90 day over due buckets, this can be an indicator of financial health and upcoming risks.

2. Daily Resident Activity (Lease Renewals, Move-in, Move-outs, etc.)

Your properties’ performance is derived from how new, current and old tenants are behaving. Staying ahead of move-outs with new tenants is key to keeping vacancy low. Ensuring renewal rates stay high is also key, as finding new tenants is typically more expensive than keeping old ones in place.

3. Financial Statements

The income statement, balance sheet, and statement of cash flows are the lifeblood of real estate. Keeping an updated record of your financials in your accounting platform is critical, and even moreso is being able to analyze your entire portfolio to identify trends and predict future performance.

4. Occupancy

The health of any property is often determined by the occupancy rate. Keeping occupancy around 90% typically means that you are running your business at maximum efficiency.

5. Prospect Conversion Ratios

The sales and marketing of a real estate company comes down to how many showings or applications occur and how many of those are being converted to leases. Low conversions can signal problems in the leasing and showing process that need to be reviewed.

6. Make Ready / Spec Suites

In a multifamily property, when a tenant leaves a property, the unit enters a make ready state to be prepared for the next tenant. Keeping make ready days low is vital as every day unrented is revenue lost. Having too many properties in the make ready state also stresses the construction team, adding more days to get more units ready for rent. On the commercial side, preparing spec suites quickly for tenants to walk through (in person or digitally) and visualize their space is critical. Minimizing the time to build spec suites similarly reduces stress on the leasing and construction teams.

7. Work Orders

Managing work orders in a timely manner helps to keep tenant satisfaction high as well as reduce capital expenses. Ensuring no major capital issues fall through the cracks while monitoring vendors is a vital KPI for any CRE organization.

8. Evictions

The dreaded eviction is a nightmare for the tenant as well as owners and managers. High eviction trends may indicate an issue in the tenant review process that need to be remediated as soon as possible.

9. Budget to Actuals

Tracking income and expenses to budgets helps ensure that there are no major deviations to your construction or renovation project – or simply your daily and weekly targets – and enables you to adjust the scope as needed.

10. Tenant Analytics

Keeping a bad tenant around may be worse then keeping a unit or space occupied. By having insight into all of your tenants’ payment, work order, and other requests’ history, you can easily identify which tenants are your most profitable and which may cause issues for you in the long term.

11. Job Cost

Understanding both capital expenses and project timelines is critical. Extracting the job cost module data from Yardi enables you to better understand the blockers in your construction and renovation processes and how you could become even more efficient.

12. Portfolio Analytics

By extracting all of your properties’ data from Yardi, you can easily group properties into funds or portfolios. This process empowers you to see whether a certain city or MSA is outperforming another area, giving you insight on where you should invest more of your time and money for higher profits.

Conclusion

We hope you found value in the 12 Best Commercial Real Estate KPIs above. If you need help building reports and identifying your KPIs, be sure to reach out on our contacts page!

Can’t get enough of commercial real estate KPIs? Check out our other blog posts on this topic:

- The Top 14 Commercial Real Estate KPIs for Property Manager to Client Reporting

- The Top 17 Real Estate KPIs for Investor Reporting

Want to learn more? Come explore our interactive demo reports and see how our free Power BI real estate analytics can help you grow!

12 Best Commercial Real Estate KPIs