Easy-To-Use Reporting and Analytics

You can now access even more easy-to-use reporting and analytics with CREx Software, including the reports below. If you have an analytics team, you can use our data integration product, The Exchange, to quickly and easily build your own analytics with Power BI, Domo, Lookr, and more.

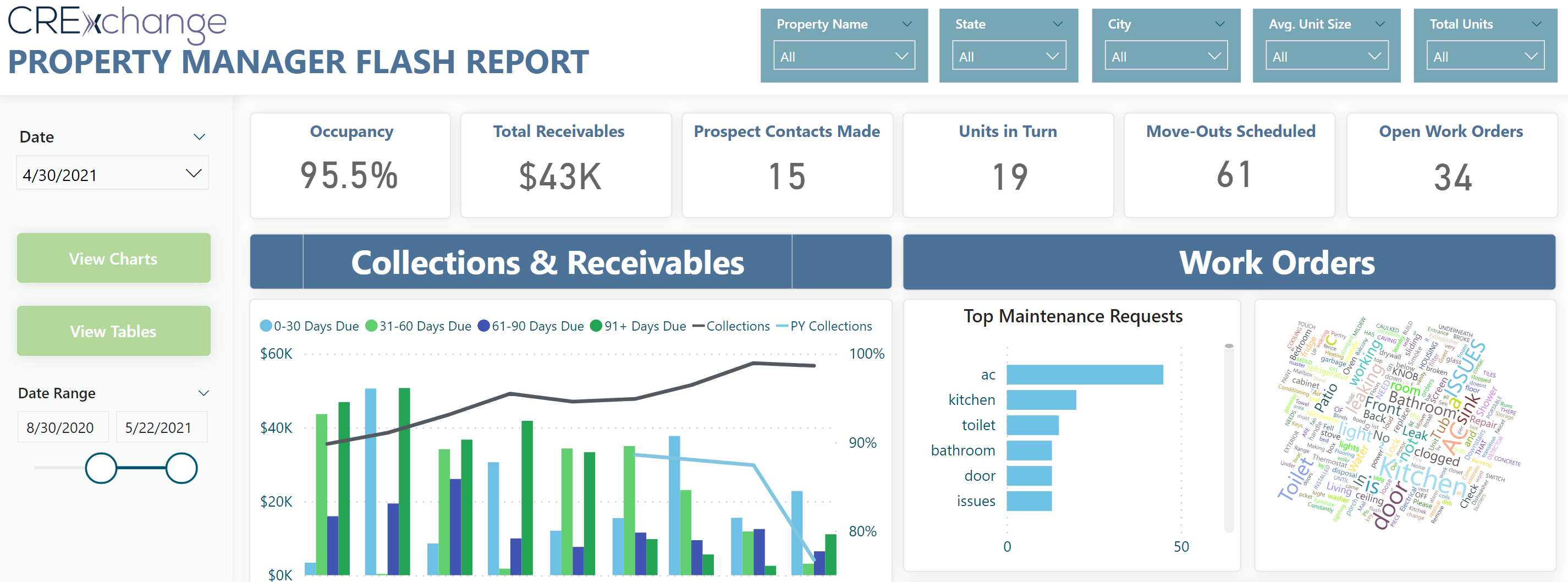

Property Manager Flash Report

Property managers should have access to their key performance indicators (KPIs) literally at the touch of their fingertips. Understanding the health of each property empowers them to ensure tenants are happy and resigning leases.

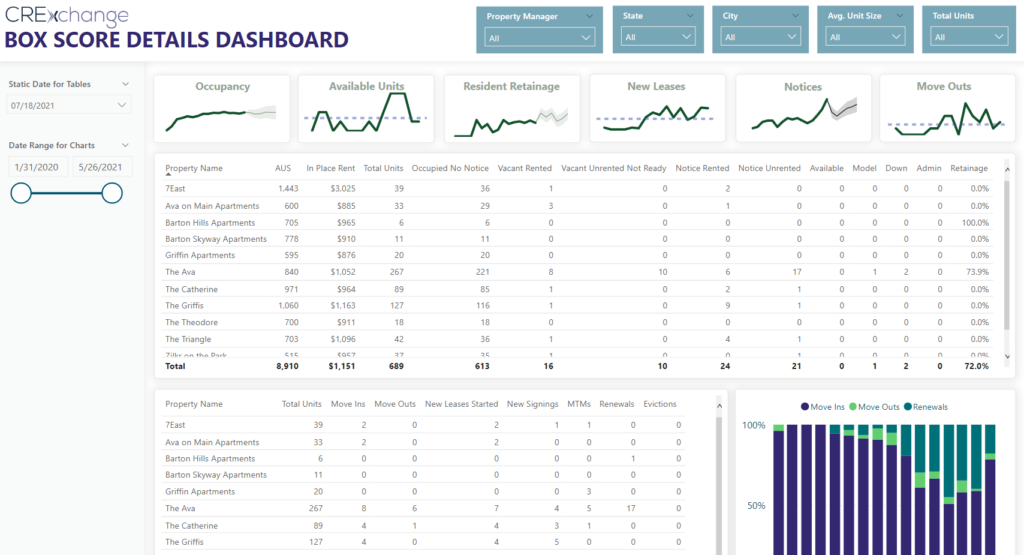

Box Score Report

Your tenants’ KPIs demonstrate trends in new, current and prior tenant behavior. For example, staying ahead of notices to vacate and move-outs helps you keep vacancy low. Ensuring renewal rates, also known as resident retainage, stay high is also key for core property management strategies, as finding new tenants typically has a lower return on cost than keeping current ones.

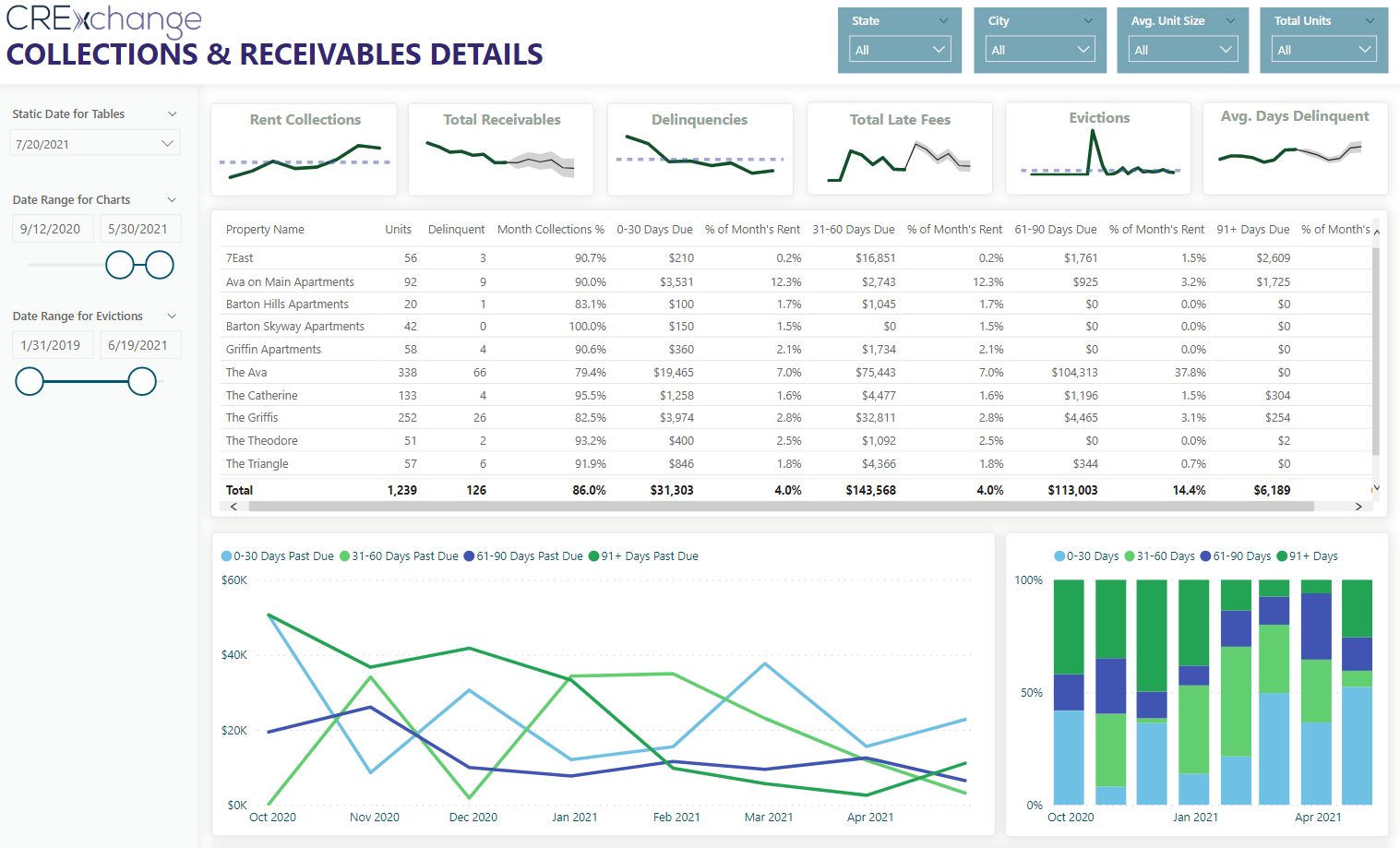

Collections and Receivables Report

Collections are one of the most important KPIs property managers and real estate owners must monitor and track. Most receivables reports show how much is due and by whom. Yardi’s aged receivables report is prime for extension into a custom report that can be analyzed week-over-week, month-over-month, or year-over-year to evaluate trends. Further, indicators such as the property’s location, new businesses in the area, or even weather patterns help plan for collection trends or issues that can be mitigated.

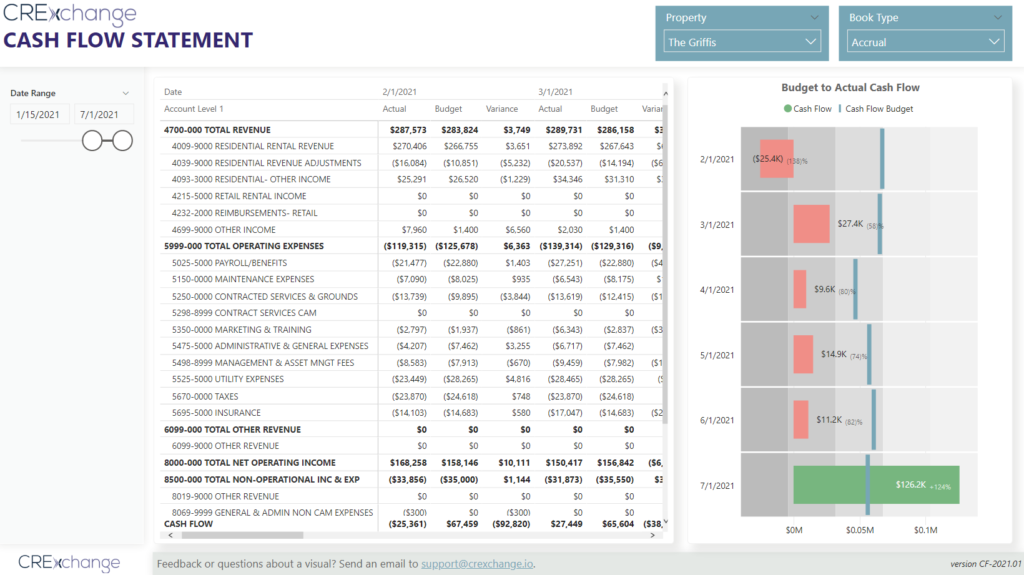

Cash Flow Report

Cash flow is a key financial metric for real estate owners and managers. Cash flow is the difference between income and expenses adjusted for noncash items, such as depreciation expense. The higher your properties’ cash flow, the better the long-term returns will be for owners and investors.

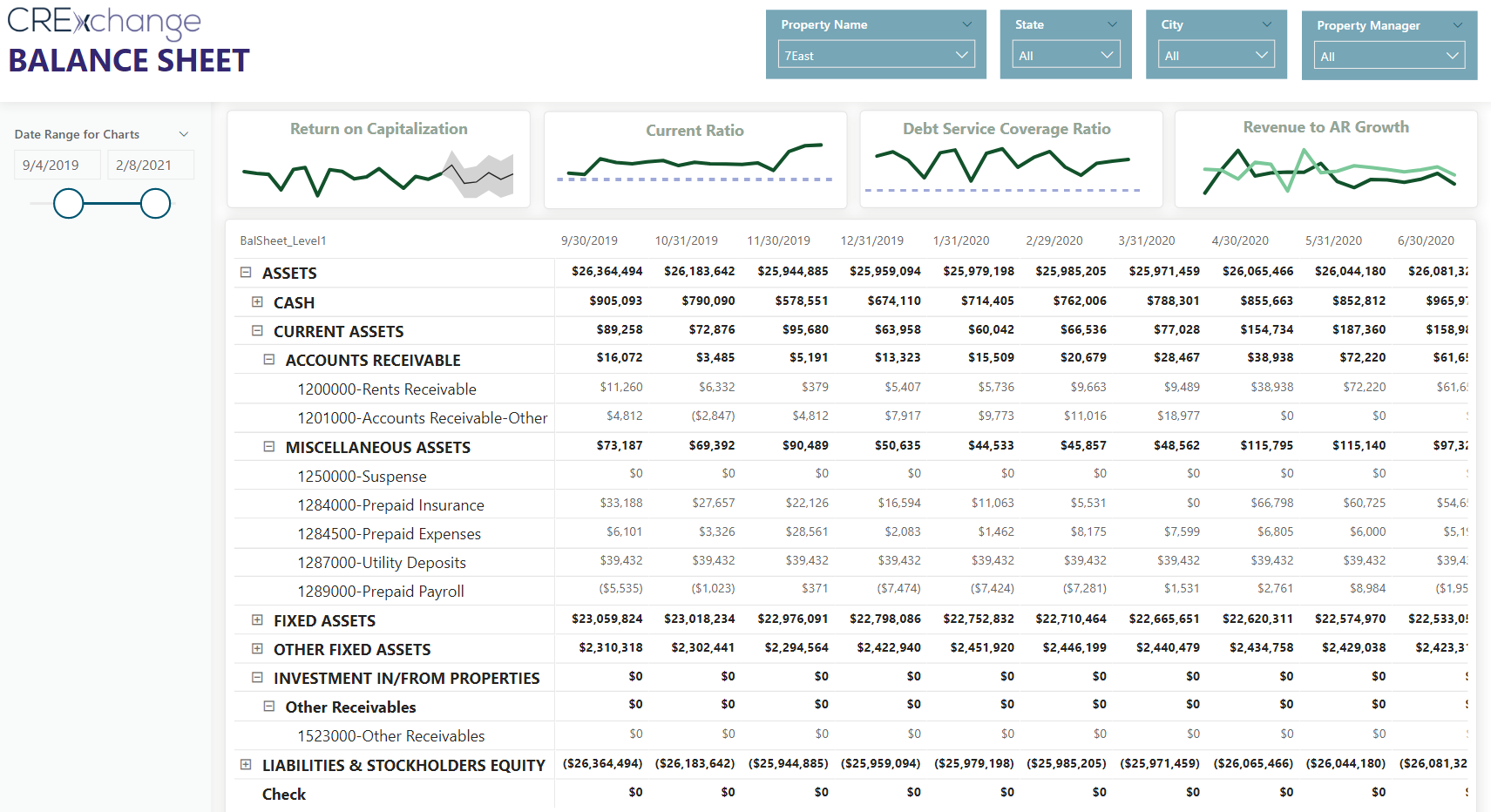

Balance Sheet Report

The balance sheet is one of the core financial reports a real estate firm should use daily. A standard balance sheet provides an month-end snapshot of your properties’ financial health. By trending balance sheet data over time, you can anticipate changes in KPIs that are critical to understand your properties’ performance and lender compliance.

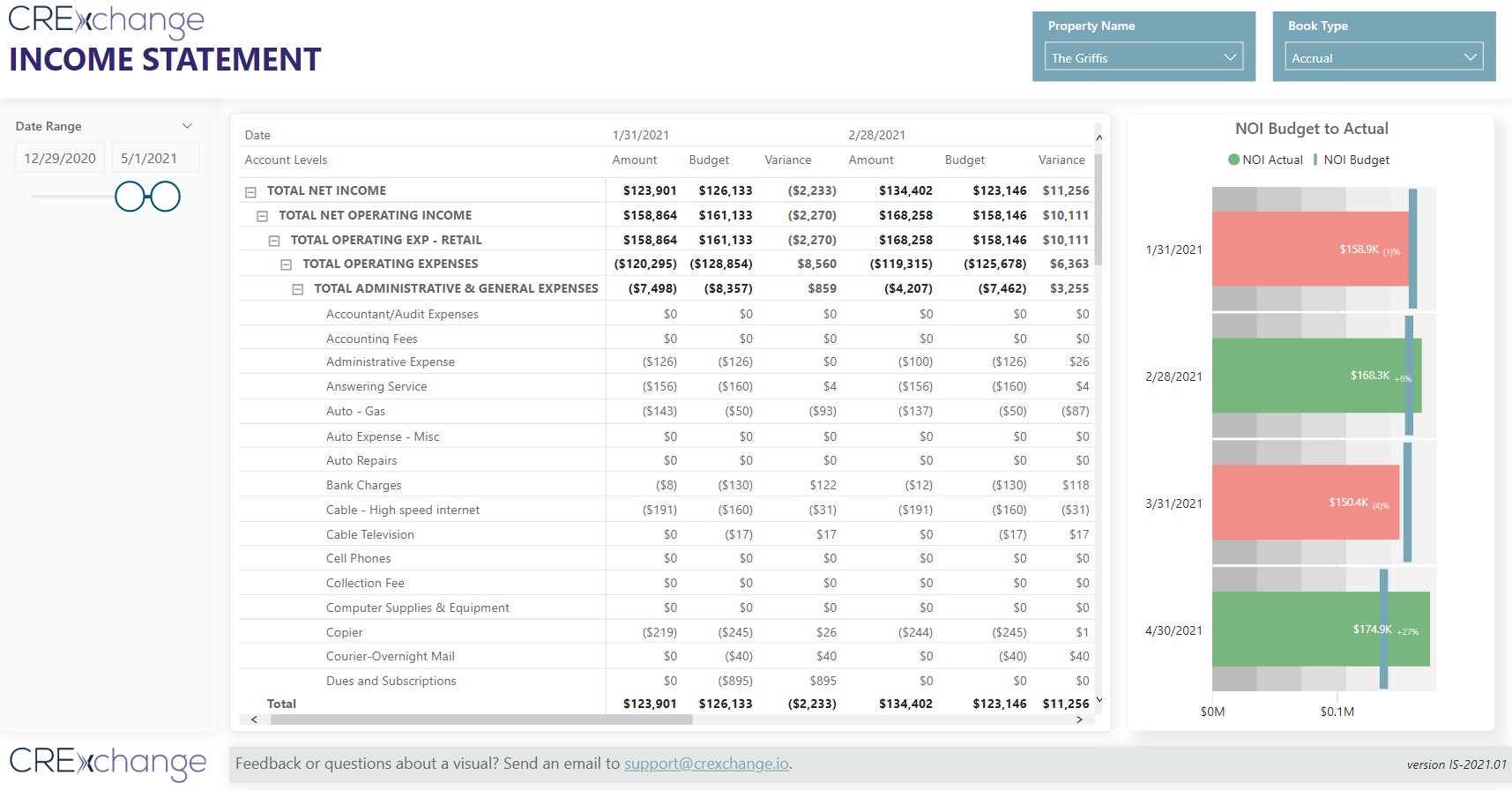

Income Statement Report

The income statement is key to understanding whether a property is a good investment and performing in line with the business plan. The income statement, and particularly net operating income (NOI), drive how much owners earn in profit when selling a property. Further, owners may use income statement data to evaluate whether a property is appropriately valued compared to market capitalization rates during underwriting. Property managers benefit by continually comparing income statement actuals to budget and ensuring that properties’ performance is on par with or exceeding owners’ expectations.